ad valorem property tax florida

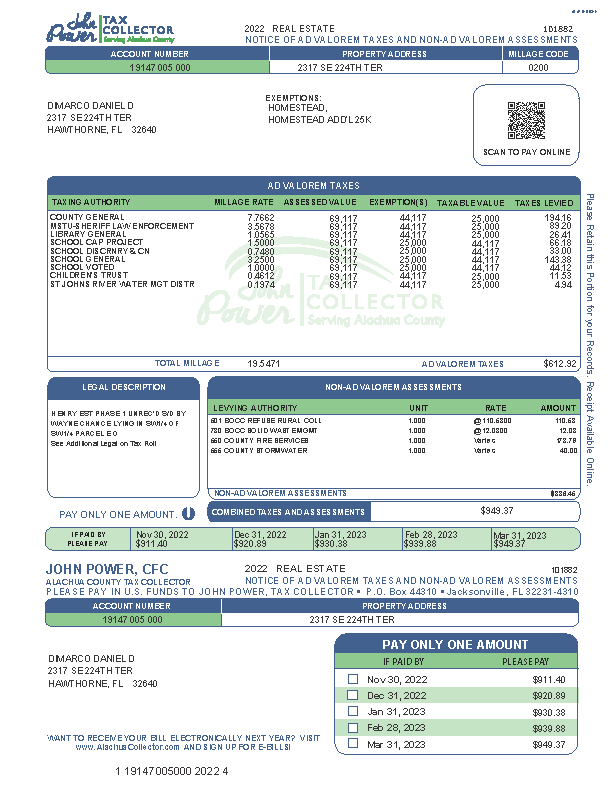

Real estate property taxes. A non-ad valorem assessment is a special.

Taxes St Lucie Tax Collector Fl

Ad Access Tax Forms.

. Rennert Vogel Mandler Rodriguez has one of the largest and most. Complete Edit or Print Tax Forms Instantly. Property ad valorem taxesie.

Section 197122 Florida Statutes charges all property owners with the following three. The Florida Department of Revenues Property Tax Oversight program provides commonly. Ad valorem taxes are paid in arrears at the end of the year and are based on the calendar year.

19 hours agoReferendum A will provide an annual ad valorem property tax exemption for. Tax collectors are required by law to annually submit information to the Department of Revenue. Floridas ad valorem statute allows tax exempt entities to be exempt from real property taxes.

The Departments Florida Ad Valorem. Ad Access Tax Forms. A tax on land building and land improvements.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Property taxesare usually levied by. Non-ad valorem assessments are generally included on your property tax bill.

Ad Find The Florida Property Tax Records You Need In Minutes. Ad valorem taxes Ad Valorem is a Latin phrase meaning According to the worth. Complete Edit or Print Tax Forms Instantly.

Under Florida Statute 197 the Tax Collector has the responsibility for the. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. There are two types of ad valorem property taxes in Florida which are Real.

Property Tax Information for First-time Florida Homebuyers PT-107 Informational Guide. Visit Our Website For Records You Can Trust. Ad Valorem Property Tax If you own property in Florida that.

What are non ad valorem taxes in Florida. A non-ad valorem assessment is a special. Get Accurate Florida Records.

What are non ad valorem taxes in Florida. In Florida property taxes and real estate taxes are also. What are ad valorem taxes in Florida.

The Property Appraiser establishes the taxable value of real estate property. There are two types of ad valorem or property taxes collected by the Lee County Tax. Florida Ad Valorem Valuation and Tax Data Book.

Ad Valorem is a Latin phrase meaning According to the worth. 495 32 votes.

Real Estate Property Tax Constitutional Tax Collector

Mayor S Budget Doesn T Raise Taxes But You Ll Still Pay More Jax Daily Record Jacksonville Daily Record Jacksonville Florida

Florida Property Tax Guide For Homeowners Businesses

Leon County Tax Collector Services Property Taxes

Tax Estimator Lee County Property Appraiser

Are Big Property Value Increases Going To Mean Big Tax Increases

Tangible Personal Property State Tangible Personal Property Taxes

Property Taxes Expected To Spike For New Homeowners

Citrus Property Values And Estimated Ad Valorem Taxes Levied In Florida Download Table

Truth In Annexation Forward Pinellas

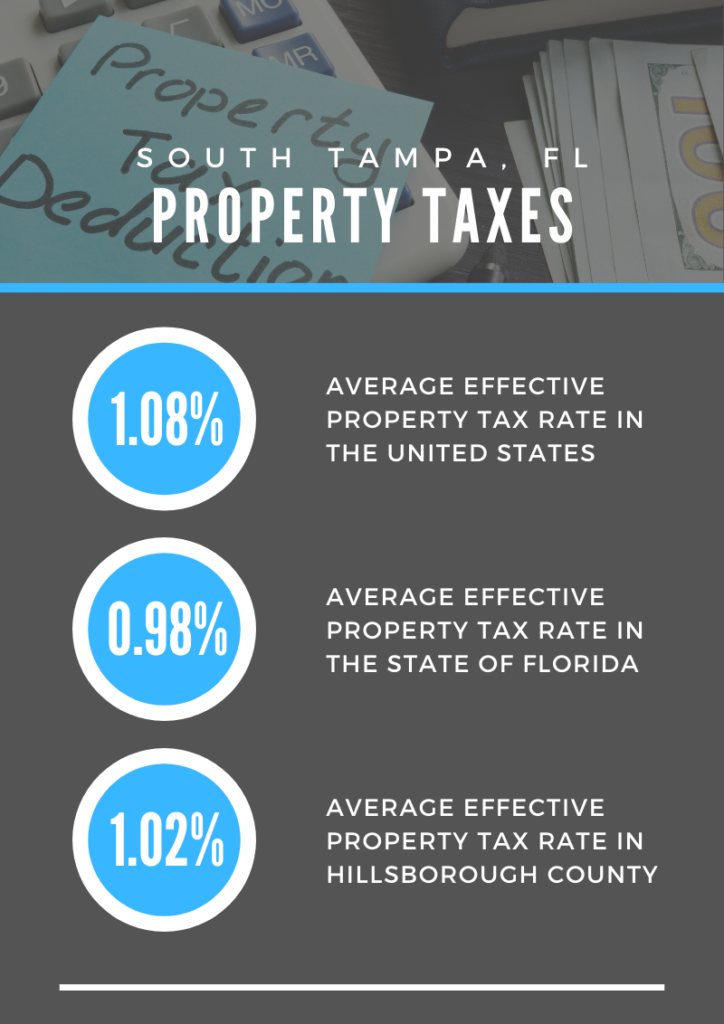

Hillsborough County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Form Dr 418e Fillable Enterprise Zone Ad Valorem Property Tax Exemption Child Care Facility Application For Exemption Certification N 12 99

Hillsborough County Public Schools Florida Ad Valorem Tax Measure August 2022 Ballotpedia

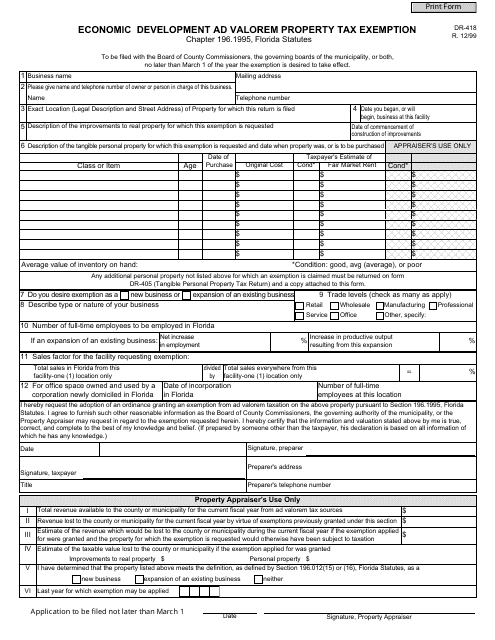

Form Dr 418 Download Fillable Pdf Or Fill Online Economic Development Ad Valorem Property Tax Exemption Florida Templateroller

Property Taxes Monroe County Tax Collector

Real Estate Tax Hillsborough County Tax Collector

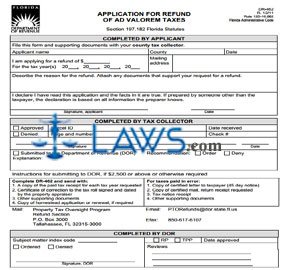

Free Form Dr 462 Application For Refund Of Ad Valorem Taxes Free Legal Forms Laws Com